WHO ARE WE...?

Watch our videos, take a look behind the scenes or scroll down to meet our team...

|

Our story so far...

|

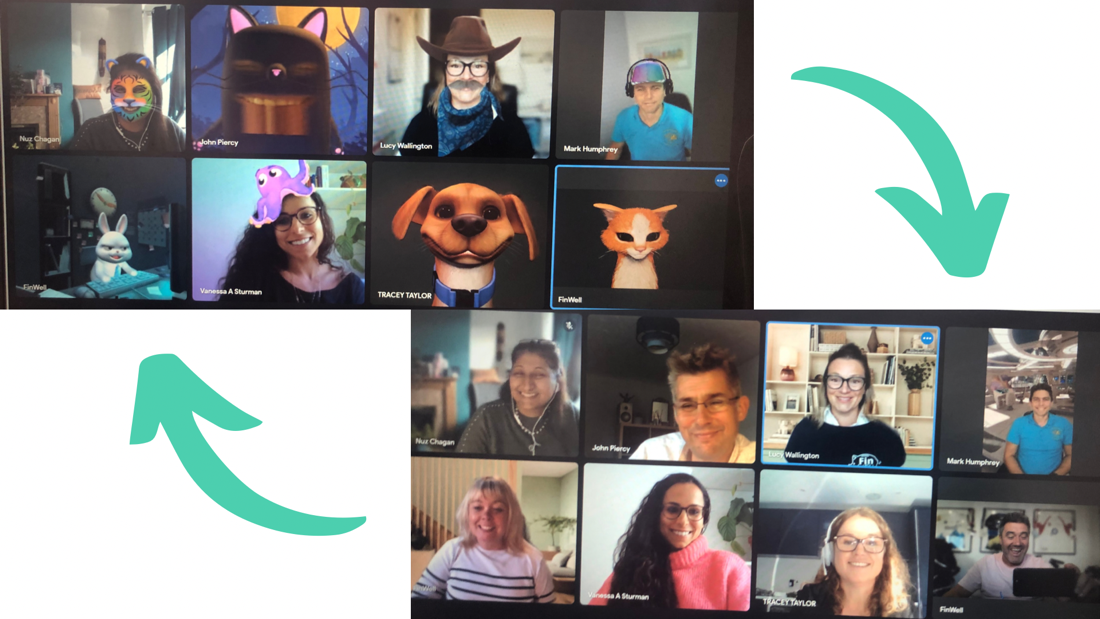

Hello from our team to yours!

|

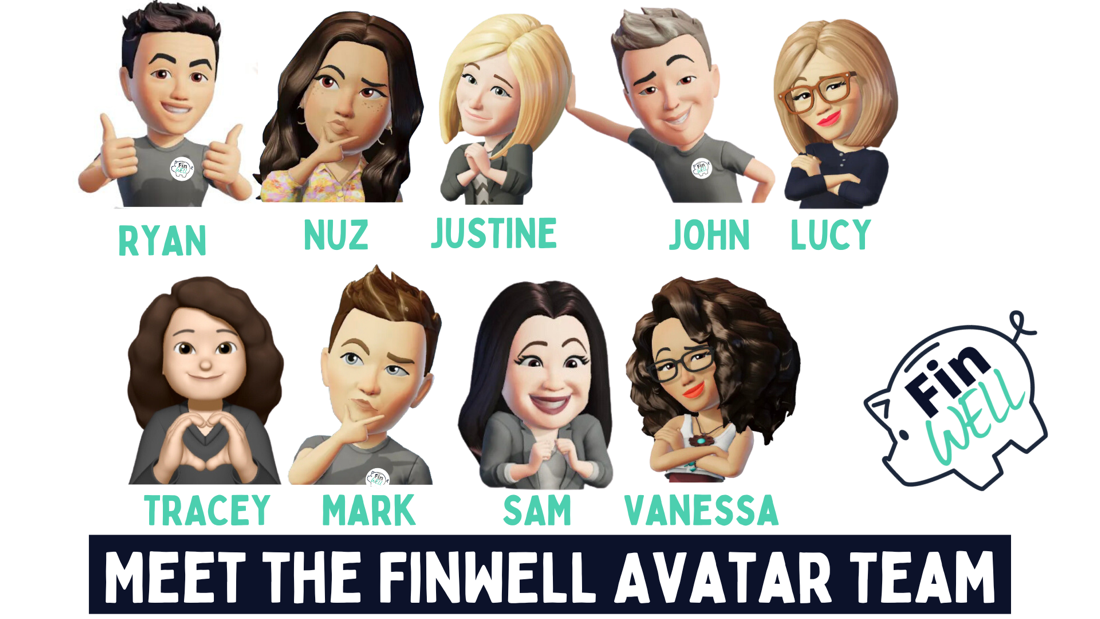

MEET THE (AWARD WINNING!) TEAM

A look behind the scenes...

Ryan Briggs - Team Captain

Ryan created FinWELL to help people understand, measure and then improve financial wellbeing, empowering them to healthier relationships with money and also better mental health having enjoyed various careers in professional sport, recruitment and financial services.

He is level four diploma qualified in financial services with over ten years experience, an accredited workplace financial education specialist, mental health first aider and keynote speaker.

In the first lockdown of 2020 he created Let’s Improve Workplace Wellbeing CIC (aka LiWW) for employers of all sizes across the UK and then set about simplifying financial wellbeing via the 'Money Matters Made Simple' mini-series of events with some of the UK’s leading organisations. Now the Financial Wellbeing Lead, this is a not-for-profit organisation that partners with The Jordan Legacy in the fight against suicide working with employers from both the public and private sector.

Ryan designed the simple four step 'FinWELL PAWA Plans' for anyone to understand, measure and improve financial wellbeing regardless of age, salary, job role, family situations, levels of experience or confidence and also additional challenges around neurodiversity.

He is passionate about bringing the very best people within financial wellbeing together to make a positive impact on peoples lives on a global scale.

Ryan is also now an ambassador and advisory board member for the Ripple Suicide Prevention Charity and a member of the Global Wellness Institute leadership team.

Outside of work he enjoys spending time with his wife and two young children and possibly even watching or playing various sports if time permits!

Qualifications & Experience:

Level Four Diploma in Financial Services | 10 years experience | Workplace Financial Education & Wellbeing Specialist | Mental Health First Aider

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | Investing for the Future | Modern Retirement Planning | Strategic Consultancy | London & South-East

He is level four diploma qualified in financial services with over ten years experience, an accredited workplace financial education specialist, mental health first aider and keynote speaker.

In the first lockdown of 2020 he created Let’s Improve Workplace Wellbeing CIC (aka LiWW) for employers of all sizes across the UK and then set about simplifying financial wellbeing via the 'Money Matters Made Simple' mini-series of events with some of the UK’s leading organisations. Now the Financial Wellbeing Lead, this is a not-for-profit organisation that partners with The Jordan Legacy in the fight against suicide working with employers from both the public and private sector.

Ryan designed the simple four step 'FinWELL PAWA Plans' for anyone to understand, measure and improve financial wellbeing regardless of age, salary, job role, family situations, levels of experience or confidence and also additional challenges around neurodiversity.

He is passionate about bringing the very best people within financial wellbeing together to make a positive impact on peoples lives on a global scale.

Ryan is also now an ambassador and advisory board member for the Ripple Suicide Prevention Charity and a member of the Global Wellness Institute leadership team.

Outside of work he enjoys spending time with his wife and two young children and possibly even watching or playing various sports if time permits!

Qualifications & Experience:

Level Four Diploma in Financial Services | 10 years experience | Workplace Financial Education & Wellbeing Specialist | Mental Health First Aider

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | Investing for the Future | Modern Retirement Planning | Strategic Consultancy | London & South-East

Justine Piercy - Training Lead

Justine is a Financial Wellbeing Consultant, with 25 years-experience in the Banking sector working for one of the UK’s largest high street banks. She has a Diploma in Management studies and is also a CeMap qualified mortgage adviser. She has spent the last 15 years in leadership roles mentoring, managing and training large teams of people. Her passion throughout her career has been coaching, developing and helping others to be the best they can be.

Since being made redundant in 2019, Justine is now passionate about helping other people become financially resilient, sharing her knowledge to support others with managing money and their long-term well-being.

Having worked as a Volunteer Ambassador for The Money charity over the last 18 months, she is now delivering financial wellbeing workshops in the workplace, providing support to employers and enhancing wellbeing programmes across the UK.

Justine lives in rural Northamptonshire with her husband, 10-year-old daughter and two crazy Springer Spaniels. In her spare-time she loves cross fit training in the gym and curling up with a good book!

Qualifications & Experience:

Diploma in Management Studies | CeMap Qualified Mortgage Adviser | 25 years experience

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | Money Management | The Property Ladder | Midlands

Since being made redundant in 2019, Justine is now passionate about helping other people become financially resilient, sharing her knowledge to support others with managing money and their long-term well-being.

Having worked as a Volunteer Ambassador for The Money charity over the last 18 months, she is now delivering financial wellbeing workshops in the workplace, providing support to employers and enhancing wellbeing programmes across the UK.

Justine lives in rural Northamptonshire with her husband, 10-year-old daughter and two crazy Springer Spaniels. In her spare-time she loves cross fit training in the gym and curling up with a good book!

Qualifications & Experience:

Diploma in Management Studies | CeMap Qualified Mortgage Adviser | 25 years experience

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | Money Management | The Property Ladder | Midlands

Emma Waller - Content Lead

Emma is the founder of MoneyMinded and our new Content Lead!

She is an award-winning financial wellbeing consultant with extensive experience of supporting people to improve their financial knowledge, skills and behaviours.

With experience working across private, public and voluntary sectors, Emma designs and delivers financial wellbeing programmes for commercial clients, charities and community groups and most notably co-authored Martin Lewis’s “Your Money Matters” book.

She provides content and training for a number of national organisations including the NHS and other government departments, high street retailers and national charities.

Emma regularly delivers financial wellbeing workshops in the workplace and in community settings, she also provides support to schools and colleges, helping them embed financial education across the curriculum. Emma also has over 20 years’ experience in education, firstly as a Teacher of Economics and Business, followed by roles in Senior Leadership as Director of Learning and Assistant Principal responsible for performance and standards.

Emma is the founder of MoneyMinded and our new Content Lead!

She is an award-winning financial wellbeing consultant with extensive experience of supporting people to improve their financial knowledge, skills and behaviours.

With experience working across private, public and voluntary sectors, Emma designs and delivers financial wellbeing programmes for commercial clients, charities and community groups and most notably co-authored Martin Lewis’s “Your Money Matters” book.

She provides content and training for a number of national organisations including the NHS and other government departments, high street retailers and national charities.

Emma regularly delivers financial wellbeing workshops in the workplace and in community settings, she also provides support to schools and colleges, helping them embed financial education across the curriculum. Emma also has over 20 years’ experience in education, firstly as a Teacher of Economics and Business, followed by roles in Senior Leadership as Director of Learning and Assistant Principal responsible for performance and standards.

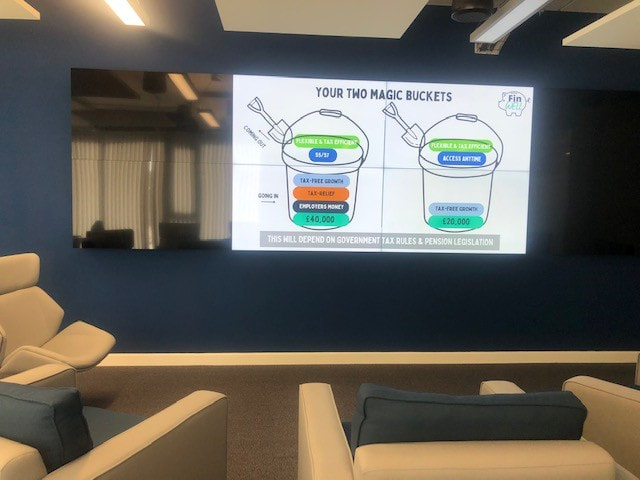

John Piercy - Pensions & Investments

John is a Financial Wellbeing Consultant, with over 30 years-experience in the financial services industry working for some of the UK’s largest high street banks and Wealth Management companies.

He is Level 4 diploma qualified in Financial Services, a CeMap qualified Mortgage Adviser and holds several leadership and management diplomas. He has spent most of his career in leadership roles mentoring, managing and training large teams of advisers across the full financial spectrum. He had a real passion for helping advisers find financial solutions that really make a difference to their customers and families.

Since the pandemic John has used his skills and experience working with businesses to help their employees become more financially resilient, plan and achieve longer-term financial goals and find greater financial wellbeing in their lives.

John lives in rural Northamptonshire with his wife, 11-year-old daughter and three dogs. He is a keen cyclist and runner, Chair of his local Parish Council, and also finds time to play the guitar (very badly!).

Qualifications & Experience:

Level Four Diploma in Financial Services | CeMap Qualified Mortgage Adviser | Several Leadership and Management Diplomas | 30 years experience

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | Investing for the Future | Modern Retirement Planning | The Property Ladder | Protecting Income & Family | Money Management | Midlands

He is Level 4 diploma qualified in Financial Services, a CeMap qualified Mortgage Adviser and holds several leadership and management diplomas. He has spent most of his career in leadership roles mentoring, managing and training large teams of advisers across the full financial spectrum. He had a real passion for helping advisers find financial solutions that really make a difference to their customers and families.

Since the pandemic John has used his skills and experience working with businesses to help their employees become more financially resilient, plan and achieve longer-term financial goals and find greater financial wellbeing in their lives.

John lives in rural Northamptonshire with his wife, 11-year-old daughter and three dogs. He is a keen cyclist and runner, Chair of his local Parish Council, and also finds time to play the guitar (very badly!).

Qualifications & Experience:

Level Four Diploma in Financial Services | CeMap Qualified Mortgage Adviser | Several Leadership and Management Diplomas | 30 years experience

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | Investing for the Future | Modern Retirement Planning | The Property Ladder | Protecting Income & Family | Money Management | Midlands

Mark Humphrey - The Property Ladder

Mark is passionate about helping busy young professionals buy their first and next homes, taking the time, stress and hassle out of the buying and moving process and is the director of MHC Mortgage & Protection Ltd.

It's often the case that people don't have time or know where to seek help or advice, with many simply delaying or overlooking these important financial decisions.

Mark delivers interactive group workshops and 1-1 guidance sessions for FinWELL and he is also one of our specialists around the property ladder and how to protect what is important.

Previously, Mark had extensive experience within the Health and Insurance sector with Bupa and so is also passionate about educating people around the ways they can protect their incomes and their families.

Outside of work he is a family man with a fantastic wife a three wonderful young daughters.

When time allows, long-distance running is his third passion and has even had a brief flirtation with stand-up comedy!

Qualifications & Experience:

CeMap Qualified Mortgage Adviser | 20 years experience

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | The Property Ladder | Protecting Income & Family | Employee Benefits | London & South-East

It's often the case that people don't have time or know where to seek help or advice, with many simply delaying or overlooking these important financial decisions.

Mark delivers interactive group workshops and 1-1 guidance sessions for FinWELL and he is also one of our specialists around the property ladder and how to protect what is important.

Previously, Mark had extensive experience within the Health and Insurance sector with Bupa and so is also passionate about educating people around the ways they can protect their incomes and their families.

Outside of work he is a family man with a fantastic wife a three wonderful young daughters.

When time allows, long-distance running is his third passion and has even had a brief flirtation with stand-up comedy!

Qualifications & Experience:

CeMap Qualified Mortgage Adviser | 20 years experience

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | The Property Ladder | Protecting Income & Family | Employee Benefits | London & South-East

Lucy Wallington - Budgeting Queen

Lucy brings over 30 years experience as a HR & people lead working with the likes of Gap & Apple.

Looking after her team’s wellbeing & engaging them in their personal development was one of her great passions and strengths.

With a keen interest in money management, Lucy has transitioned into helping others create the best foundation with their personal finances so that they can move towards what they really want in life.

We all have different stages and seasons in our busy lives that find us needing different financial set ups, from starting out, moving forward as a couple or going solo.

Lucy will help you create clarity from your confusion & a budget to match your new chapter.

I live in the Kent countryside with my partner, his two dogs & my cat who often comes along on our dog walks in the orchards. It’s crowded but fun!

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | Money Management | London & South-East

Looking after her team’s wellbeing & engaging them in their personal development was one of her great passions and strengths.

With a keen interest in money management, Lucy has transitioned into helping others create the best foundation with their personal finances so that they can move towards what they really want in life.

We all have different stages and seasons in our busy lives that find us needing different financial set ups, from starting out, moving forward as a couple or going solo.

Lucy will help you create clarity from your confusion & a budget to match your new chapter.

I live in the Kent countryside with my partner, his two dogs & my cat who often comes along on our dog walks in the orchards. It’s crowded but fun!

Areas of Focus:

1-1 Guidance Sessions | Interactive Group Workshops | Financial Wellbeing | Money Management | London & South-East

Martha Lawton - Money Mindset

Matha's bio coming soon.

Tracey Taylor - Menopause & Money

Tracey is a 51-year-old perimenopausal woman and is also a certified financial protection adviser, a menopause coach, and an active member of the Financial Therapy Association.

Tracey's work with FinWELL offers a variety of services to help women manage their menopause symptoms and cope with financial overwhelm.

She is passionate about helping women thrive through perimenopause and beyond and believes that financial wellbeing is essential for women at all stages of life, but it is especially important during menopause.

These services include:

Tracey has been married for 18 years, living in Sevenoaks, Kent with her two children and cavapoo called Lolly! She speaks French and Spanish and loves travelling, baking and keeping fit through jogging and yoga.

Qualifications

10 years experience in Financial Services Cert Cii (FP), Certified Menopause Practioner, Member of the Financial Therapy Association, BA Hons Modern Langs.

Tracey's work with FinWELL offers a variety of services to help women manage their menopause symptoms and cope with financial overwhelm.

She is passionate about helping women thrive through perimenopause and beyond and believes that financial wellbeing is essential for women at all stages of life, but it is especially important during menopause.

These services include:

- Individual 1-1 Coaching

- Interactive Group Workshops

- Keynote Speaking

- Online Courses

- A soon-to-be-published book

Tracey has been married for 18 years, living in Sevenoaks, Kent with her two children and cavapoo called Lolly! She speaks French and Spanish and loves travelling, baking and keeping fit through jogging and yoga.

Qualifications

10 years experience in Financial Services Cert Cii (FP), Certified Menopause Practioner, Member of the Financial Therapy Association, BA Hons Modern Langs.

Darren Collins - Education Lead

Hi, I'm Darren! I'm a secondary school teacher in Sittingbourne, Kent and also qualified as a financial and mortgage adviser in the last few years. I was delighted to be awarded the 'Interactive Investor Financial Secondary Teacher of the year' at the backend of 2020.

Why is financial education and wellbeing so important and links to mental health?

For me financial education and wellbeing is so important to people of all backgrounds and I have seen first-hand, how having this knowledge gives people a feeling of being in more control over both their short and longer term future. This greater level of control over personal finances can have a positive impact on someone’s mental health, something that is becoming more and more relevant in our modern world.

My areas of focus...

With personal finance being so broad, my experience of educating people of all ages has always been geared towards ensuring people never make the same mistakes I made at an early age.. I have a belief that if you are able to get control over your general money management at the earliest stage then this will enable you to be able to make better long term. For example, getting your money management sorted early… something will then enable you to begin to reap the benefits of investing earl, as a result of gaining all the compounding benefits that come with getting educated and then executing on financial plans as soon as possible.

Away from work...

Away from work you'll find me keeping fit, travelling and watching football and I often try to watch a professional game of football in the country that I may be visiting. I am also currently training for a Half Ironman, so please wish me luck with that one!

Qualifications

Level Four Diploma Qualified in Financial Services

Qualified Mortgage Adviser

Why is financial education and wellbeing so important and links to mental health?

For me financial education and wellbeing is so important to people of all backgrounds and I have seen first-hand, how having this knowledge gives people a feeling of being in more control over both their short and longer term future. This greater level of control over personal finances can have a positive impact on someone’s mental health, something that is becoming more and more relevant in our modern world.

My areas of focus...

With personal finance being so broad, my experience of educating people of all ages has always been geared towards ensuring people never make the same mistakes I made at an early age.. I have a belief that if you are able to get control over your general money management at the earliest stage then this will enable you to be able to make better long term. For example, getting your money management sorted early… something will then enable you to begin to reap the benefits of investing earl, as a result of gaining all the compounding benefits that come with getting educated and then executing on financial plans as soon as possible.

Away from work...

Away from work you'll find me keeping fit, travelling and watching football and I often try to watch a professional game of football in the country that I may be visiting. I am also currently training for a Half Ironman, so please wish me luck with that one!

Qualifications

Level Four Diploma Qualified in Financial Services

Qualified Mortgage Adviser

Vanessa Sturman - Healthy Eating

Hi, I'm Vanessa and I've joined the FinWELL Team to combine finance and food helping employees to eat nutritionally and sustainably while also not costing the earth (literally!)

I’m a Plant Based Health Coach & Award-Winning Expert Speaker. I’ve been featured on Sky News and LBC, I’m a regular on BBC radio and am known for my fun and energetic approach to eating.

I help people, teams and leaders reduce fatigue, and improve performance and resilience with healthy habits and by incorporating the most delicious plant based wholefoods, whatever your diet or preferences. No fads, no 'dieting' and no missing out. Her approach is to make healthy eating fun, satisfying, inclusive and sustainable.

Corporate clients have included University of Cambridge, Octopus Electric Vehicles, Michigan State University and the Francis Crick Institute. Recent work at Michigan State University was to teach future medical students not just about nutrition for their patients, but how to implement healthy eating for themselves to thrive as doctors, and in a way that fits their student budgets. Most of these students are from poor socio-economic backgrounds. I also run fun virtual cooking classes where teams can learn to make easy dishes from leftover ingredients.

These classes are a great way of building confidence in the kitchen and providing a unique company benefit that allows people to expand their life skills.

A bit about my background...

In terms of my background, I’m a specialist in food and cooking (I previously ran a plant based recipe website). Previous to my coaching and speaking career I gained an Undergraduate and Masters degree at Cambridge University in Biological Anthropology, freelanced in Change Management implementing behaviour change and wellbeing strategies, and worked as a Sustainability Consultant. Most importantly, I’ve walked the talk of healthy eating for 20 years after getting caught up in damaging dieting as a teenager, when I decided restriction just doesn’t work, and eating has to support mental and physical health.

I’m of mixed-heritage – white and Bahamian (a group of Caribbean islands). My grandmother was a single black mother in the 60s of Liverpool. My mother and grandmother had to survive on very little and had no financial safety net. I inherited some of the most powerful budgeting skills to ensure the family was well nourished and could still eat the tastiest food, but always looking after the pennies. I wouldn’t know the tricks I know today if it wasn’t for my wonderful grandmother and mother, and the struggles they went through, despite me having a much more privileged upbringing than them.

How are food and finances linked?

Food is essential – we can’t just give it up to save money! More importantly, food is essential to keep us in good health and functioning optimally, both physically and mentally. When we eat poor food or have unhealthy habits, this affects our energy levels and immunity. When we’re sick, this affects our ability to perform at our jobs, in our relationships and ultimately costs us time and money.

We are advertised food products 24/7, and nutrition has become confusing for many. It’s easy to run and buy quick fixes for our health that can drain our bank balances. We need to make healthy choices but without these breaking the bank for a sustainably healthy way of eating that doesn’t cause stress.

I'm excited to join the FinWELL Team because...

I’m excited to join a fun team of diverse and talented individuals to deliver work that truly improves people’s lives and gives them the skill that can transform their lives.

The FinWell team are experts in their own areas, and I love that we’ve come together to offer fun, engaging and educational activities to employees.

Outside of work I am...

An energetic and curious person who loves travel, trying out delicious food, dancing and meeting new people.

When I have time I love going to galleries and exhibitions to learn new things, and really enjoy self development conferences. Learning and developing my mind I believe is never-ending journey that helps strengthens relationships and especially the one you have with yourself.

I like to keep active with yoga and resistance training, as well as enjoying nature and the world’s natural wonders.

I’m a Plant Based Health Coach & Award-Winning Expert Speaker. I’ve been featured on Sky News and LBC, I’m a regular on BBC radio and am known for my fun and energetic approach to eating.

I help people, teams and leaders reduce fatigue, and improve performance and resilience with healthy habits and by incorporating the most delicious plant based wholefoods, whatever your diet or preferences. No fads, no 'dieting' and no missing out. Her approach is to make healthy eating fun, satisfying, inclusive and sustainable.

Corporate clients have included University of Cambridge, Octopus Electric Vehicles, Michigan State University and the Francis Crick Institute. Recent work at Michigan State University was to teach future medical students not just about nutrition for their patients, but how to implement healthy eating for themselves to thrive as doctors, and in a way that fits their student budgets. Most of these students are from poor socio-economic backgrounds. I also run fun virtual cooking classes where teams can learn to make easy dishes from leftover ingredients.

These classes are a great way of building confidence in the kitchen and providing a unique company benefit that allows people to expand their life skills.

A bit about my background...

In terms of my background, I’m a specialist in food and cooking (I previously ran a plant based recipe website). Previous to my coaching and speaking career I gained an Undergraduate and Masters degree at Cambridge University in Biological Anthropology, freelanced in Change Management implementing behaviour change and wellbeing strategies, and worked as a Sustainability Consultant. Most importantly, I’ve walked the talk of healthy eating for 20 years after getting caught up in damaging dieting as a teenager, when I decided restriction just doesn’t work, and eating has to support mental and physical health.

I’m of mixed-heritage – white and Bahamian (a group of Caribbean islands). My grandmother was a single black mother in the 60s of Liverpool. My mother and grandmother had to survive on very little and had no financial safety net. I inherited some of the most powerful budgeting skills to ensure the family was well nourished and could still eat the tastiest food, but always looking after the pennies. I wouldn’t know the tricks I know today if it wasn’t for my wonderful grandmother and mother, and the struggles they went through, despite me having a much more privileged upbringing than them.

How are food and finances linked?

Food is essential – we can’t just give it up to save money! More importantly, food is essential to keep us in good health and functioning optimally, both physically and mentally. When we eat poor food or have unhealthy habits, this affects our energy levels and immunity. When we’re sick, this affects our ability to perform at our jobs, in our relationships and ultimately costs us time and money.

We are advertised food products 24/7, and nutrition has become confusing for many. It’s easy to run and buy quick fixes for our health that can drain our bank balances. We need to make healthy choices but without these breaking the bank for a sustainably healthy way of eating that doesn’t cause stress.

I'm excited to join the FinWELL Team because...

I’m excited to join a fun team of diverse and talented individuals to deliver work that truly improves people’s lives and gives them the skill that can transform their lives.

The FinWell team are experts in their own areas, and I love that we’ve come together to offer fun, engaging and educational activities to employees.

Outside of work I am...

An energetic and curious person who loves travel, trying out delicious food, dancing and meeting new people.

When I have time I love going to galleries and exhibitions to learn new things, and really enjoy self development conferences. Learning and developing my mind I believe is never-ending journey that helps strengthens relationships and especially the one you have with yourself.

I like to keep active with yoga and resistance training, as well as enjoying nature and the world’s natural wonders.

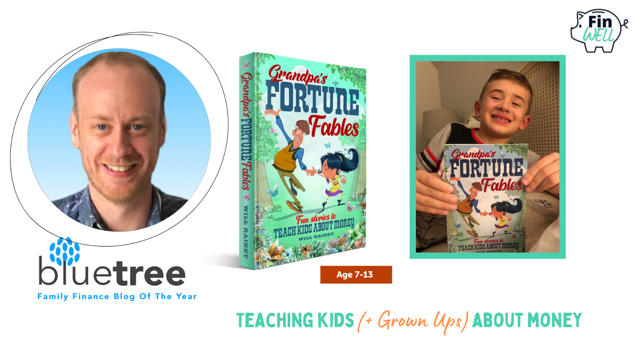

Will Rainey is a writer and speaker focused on helping parents teach their kids about money. He is the author of the children's book, Grandpa's Fortune Fables. His work has appeared in the Financial Times, iNews and The National News.

His website, bluetreesavings.com, has helped thousands of parents start talking to their kids about money. He has been invited to speak at Fortune 500 (Global) companies.

Will was an award-winning investment consultant providing investment advice to governments, insurance companies and some of the world's largest pension schemes.

His content features in the FinWell Hub and is available to book for online group workshops as part of your financial wellbeing programme with FinWell.

Areas of Focus:

Interactive Group Workshops | Financial Wellbeing | Investing for Parents & Children

His website, bluetreesavings.com, has helped thousands of parents start talking to their kids about money. He has been invited to speak at Fortune 500 (Global) companies.

Will was an award-winning investment consultant providing investment advice to governments, insurance companies and some of the world's largest pension schemes.

His content features in the FinWell Hub and is available to book for online group workshops as part of your financial wellbeing programme with FinWell.

Areas of Focus:

Interactive Group Workshops | Financial Wellbeing | Investing for Parents & Children

Aly has been a solicitor working with business owners for over 25 years.

As a business owner herself, she really gets the importance of understanding and being in control of financial affairs, to maintain wellbeing.

Now running her own law firm, she focuses on helping small business owners, protect their businesses legally, to ensure maximum value and reduce the risk of financial harm.

Known as the "singing solicitor", outside work, she is a member of a community choir and is a Careers Governor at her local secondary school, where she hammers home the importance of preparing young people, not just for the world of work, but also educating them early on in life about financial matters.

She has an amazing family and a dog called Bilbo. One of her life's purposes is to help everyone she comes into contact with, be abdundant in all areas of their lives and she is excited to be part of the FinWELL team.

Areas of Focus:

Interactive Group Workshops | 1-1 Guidance Sessions | London & South-East | Business Owners | Legal Matters

As a business owner herself, she really gets the importance of understanding and being in control of financial affairs, to maintain wellbeing.

Now running her own law firm, she focuses on helping small business owners, protect their businesses legally, to ensure maximum value and reduce the risk of financial harm.

Known as the "singing solicitor", outside work, she is a member of a community choir and is a Careers Governor at her local secondary school, where she hammers home the importance of preparing young people, not just for the world of work, but also educating them early on in life about financial matters.

She has an amazing family and a dog called Bilbo. One of her life's purposes is to help everyone she comes into contact with, be abdundant in all areas of their lives and she is excited to be part of the FinWELL team.

Areas of Focus:

Interactive Group Workshops | 1-1 Guidance Sessions | London & South-East | Business Owners | Legal Matters