We can help your employees score their own financial wellbeing, identify their key challenges, establish their areas of focus and prioritise topics and themes...

Scroll down to take a look at our Construction sector case study or click the links for other sectors...

|

Andrew Russell-Day talks about the need for financial education in #FinancialWellbeingMonth

|

Dr Judith Grant discusses financial wellbeing within the construction industry

|

Analysis

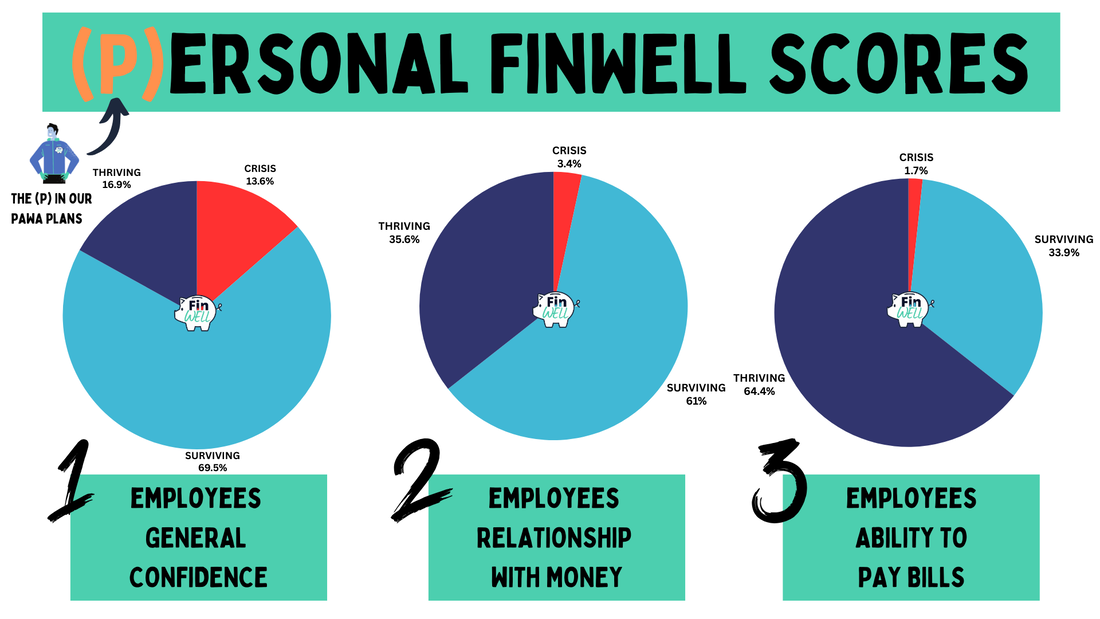

Once employees understood the FinWELL scoring system they could score themselves using our traffic light scale that would related to either crisis, surviving or thriving for our five key elements of financial wellbeing.

You can see the results for each of these and they cover employees general confidence around managing money, their relationship with money and their ability to pay the bills, financial resilience and future plans.

Over 50% of people in the UK are not confident when it comes to managing money as we didn’t learn the basics at school and this is being further impacted by the rising cost of living, interest rates and inflation.

Employers can then implement relevant training and support in an effort to move people from crisis and surviving to thriving.

Once employees understood the FinWELL scoring system they could score themselves using our traffic light scale that would related to either crisis, surviving or thriving for our five key elements of financial wellbeing.

You can see the results for each of these and they cover employees general confidence around managing money, their relationship with money and their ability to pay the bills, financial resilience and future plans.

Over 50% of people in the UK are not confident when it comes to managing money as we didn’t learn the basics at school and this is being further impacted by the rising cost of living, interest rates and inflation.

Employers can then implement relevant training and support in an effort to move people from crisis and surviving to thriving.

Analysis

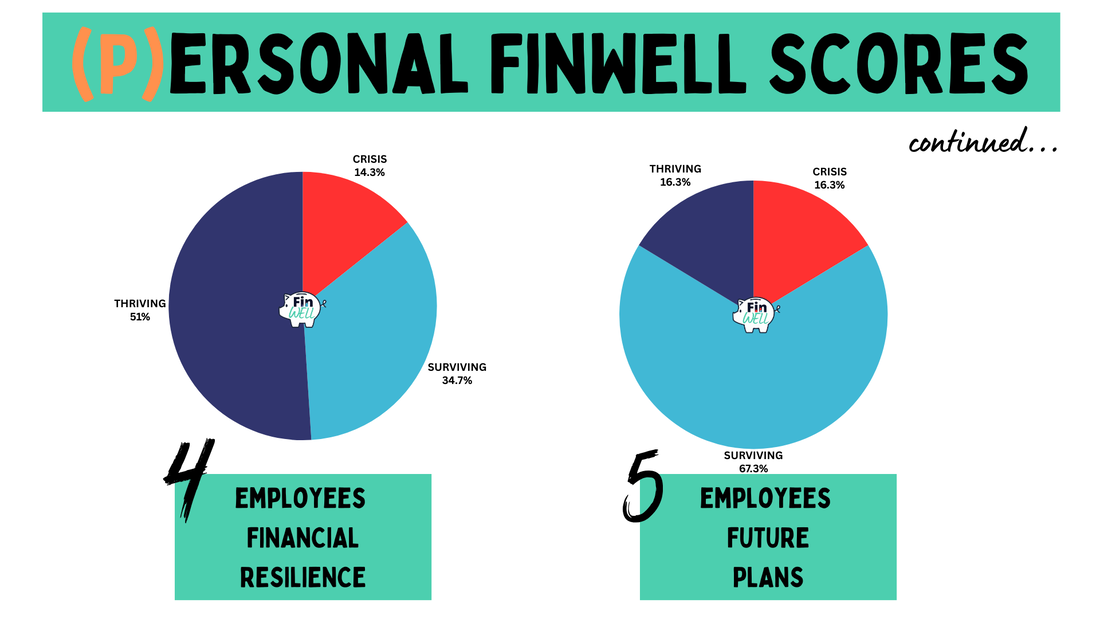

You can see that even more employees scored themselves as ‘crisis’ when it came to their financial resilience and even more again when it came to future planning. This is quite common from our data.

Research has shown that 20% of people have less than £100 in savings or ‘emergency funds’ so this is a common trend that we see.

Employees also find it hard to focus on the future as they are either trying to survive the hear and now, don’t understand ways they can make money work harder for them over the long-term or think that it’s a long way off and will have time to ‘catch up’ later.

You can see that even more employees scored themselves as ‘crisis’ when it came to their financial resilience and even more again when it came to future planning. This is quite common from our data.

Research has shown that 20% of people have less than £100 in savings or ‘emergency funds’ so this is a common trend that we see.

Employees also find it hard to focus on the future as they are either trying to survive the hear and now, don’t understand ways they can make money work harder for them over the long-term or think that it’s a long way off and will have time to ‘catch up’ later.

Analysis

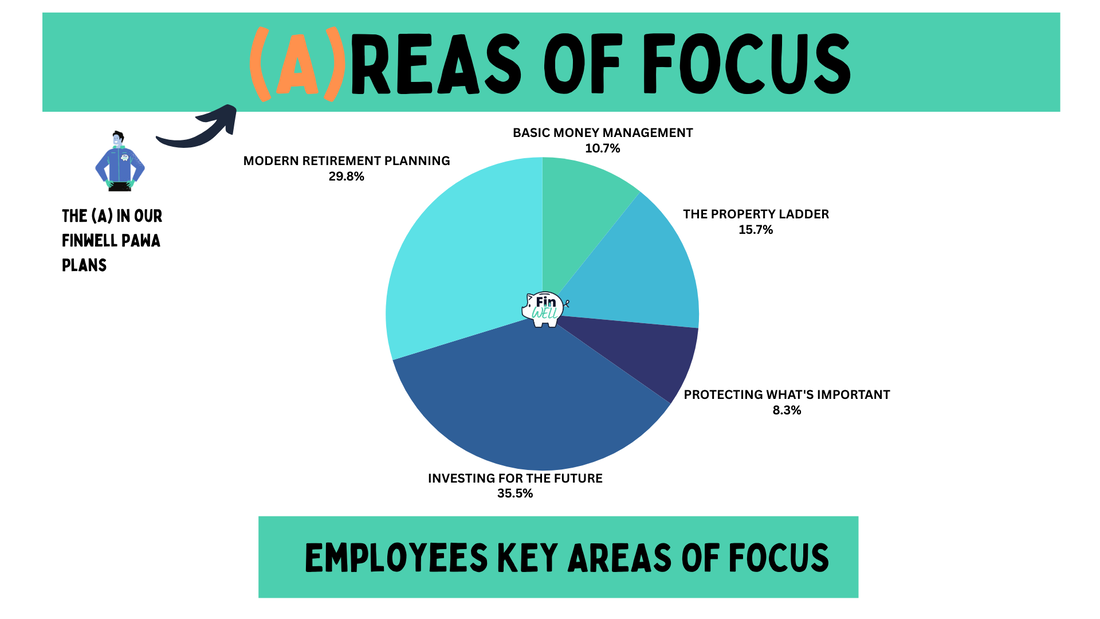

Here you can see that over half of employees selected either 'Investing For The Future' or 'Modern Retirement Planning' as their key area of focus.

We see this a lot although most start with a focus on basic money management and it depends of the demographics of employees within a company.

Here you can see that over half of employees selected either 'Investing For The Future' or 'Modern Retirement Planning' as their key area of focus.

We see this a lot although most start with a focus on basic money management and it depends of the demographics of employees within a company.

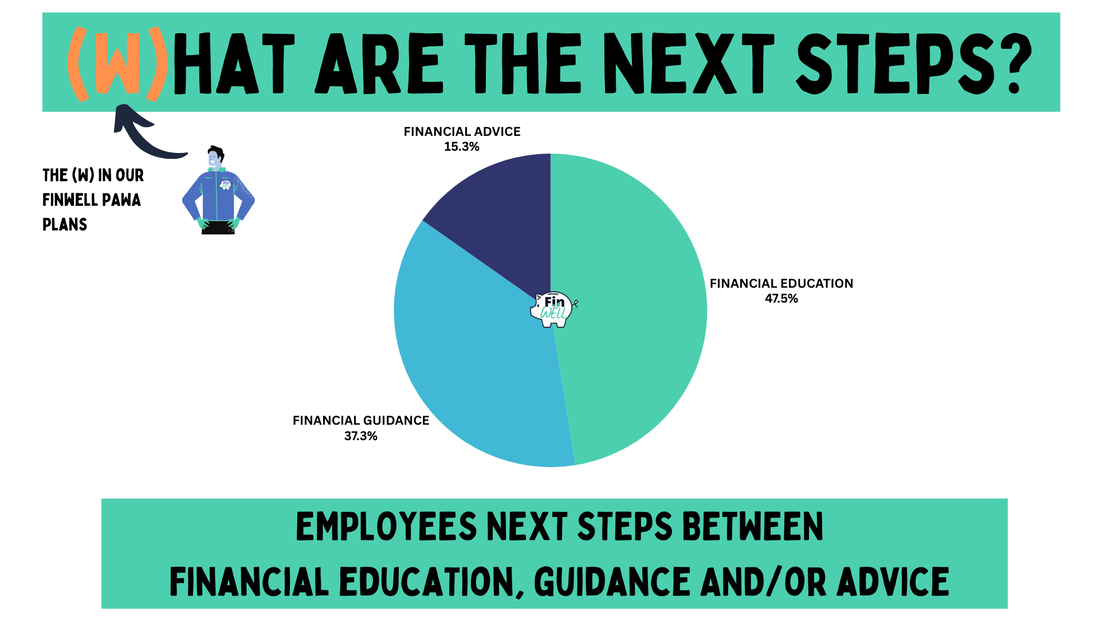

Analysis

A big exercise for our team is to explain the difference between financial education, financial guidance and financial advice.

This particular data shows that the majority of employees wanted access to trusted 'financial education' which is common and we can provide via our employer branded microsites.

The next mot popular step was 'financial guidance' which for us is either group workshops or follow up 1-1 sessions online or in-person and some establish that their next step is to consider options around financial advice*.

*FinWELL do not endorse, recommend or promote any regulated products or services such as financial advice. Instead, we can effectively signpost to existing employee benefits and providers or at least explain the options available.

A big exercise for our team is to explain the difference between financial education, financial guidance and financial advice.

This particular data shows that the majority of employees wanted access to trusted 'financial education' which is common and we can provide via our employer branded microsites.

The next mot popular step was 'financial guidance' which for us is either group workshops or follow up 1-1 sessions online or in-person and some establish that their next step is to consider options around financial advice*.

*FinWELL do not endorse, recommend or promote any regulated products or services such as financial advice. Instead, we can effectively signpost to existing employee benefits and providers or at least explain the options available.

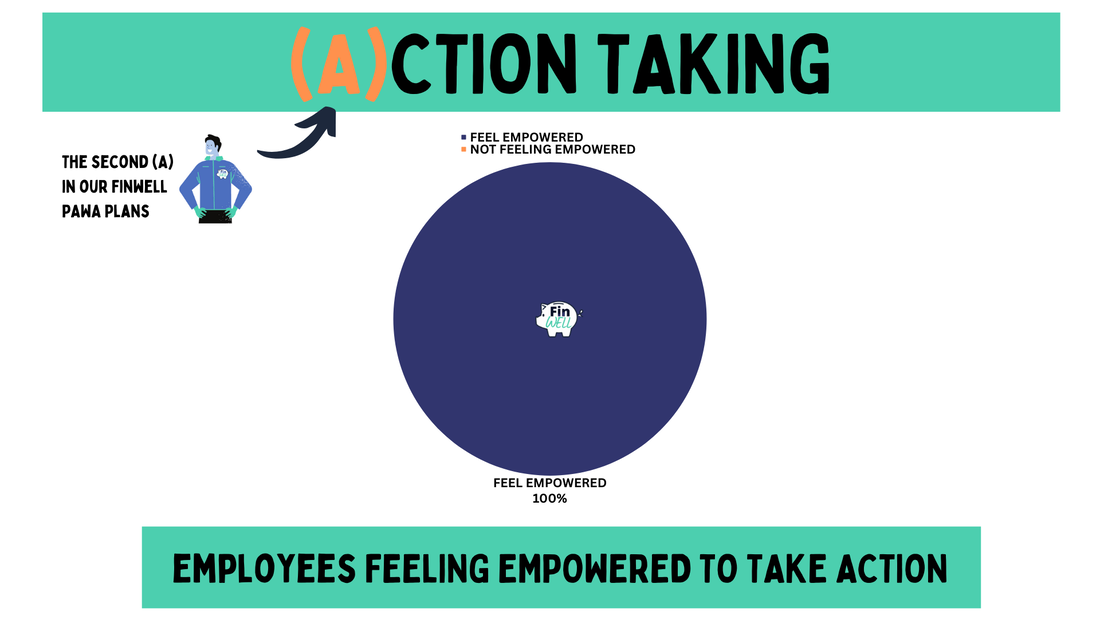

Analysis

After sharing a number of practical hints and tips, it is encouraging to see that nearly all employees felt empowered to take action.

This only comes from having an understanding of what financial wellbeing means to them, establishing their own personal FinWELL scores and also identifying their key areas of focus and interest.

After sharing a number of practical hints and tips, it is encouraging to see that nearly all employees felt empowered to take action.

This only comes from having an understanding of what financial wellbeing means to them, establishing their own personal FinWELL scores and also identifying their key areas of focus and interest.

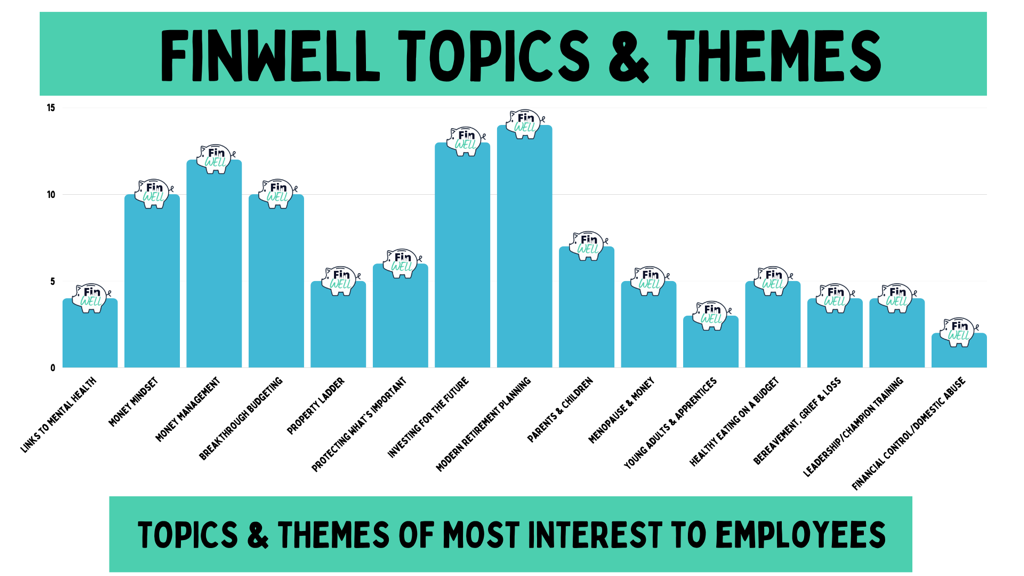

Analysis

This is a great way to ensure your approach to financial education is inclusive and personalised.

We’ve learnt how many key life events have a direct impact on our financial wellbeing and visa-versa.

Employers can now tailor support after establishing what’s most important to their teams including things like Menopause and Money, Money & Neurodiversity, FinWELL for Apprentices & Young Adults, Eating Healthily on a Budget, Bereavement, Grief, Trauma and Loss, Parenting & Caring, Divorce and even Financial Control and Economic Abuse.

This is a great way to ensure your approach to financial education is inclusive and personalised.

We’ve learnt how many key life events have a direct impact on our financial wellbeing and visa-versa.

Employers can now tailor support after establishing what’s most important to their teams including things like Menopause and Money, Money & Neurodiversity, FinWELL for Apprentices & Young Adults, Eating Healthily on a Budget, Bereavement, Grief, Trauma and Loss, Parenting & Caring, Divorce and even Financial Control and Economic Abuse.

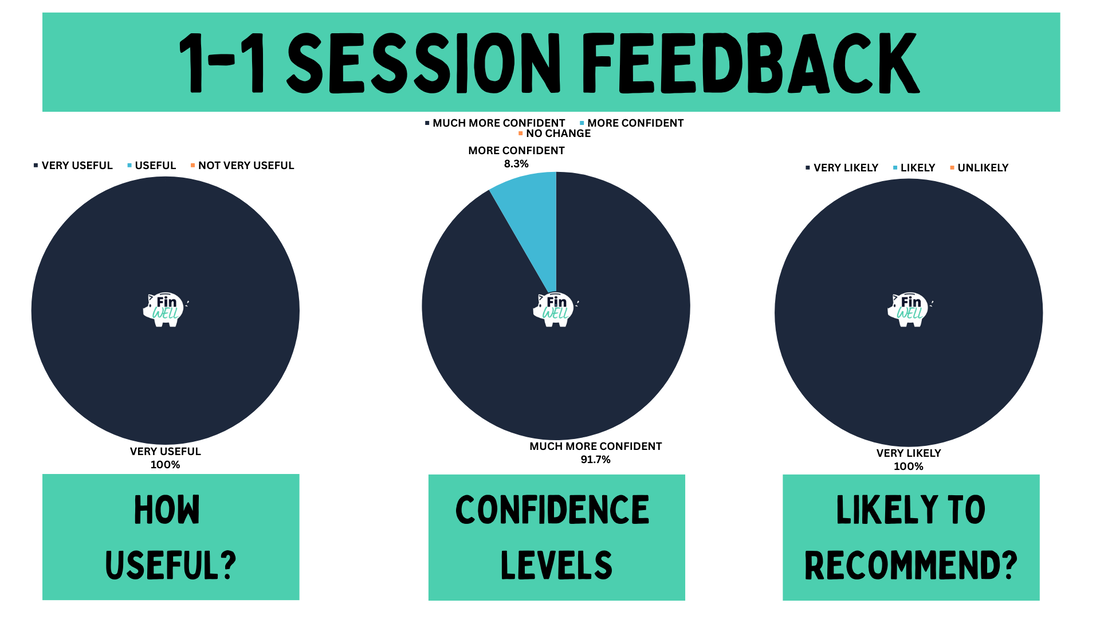

Analysis

It’s always encouraging to see that the 1-1 sessions were found to be very useful, having a positive impact on confidence levels with 100% of employees likely to recommend it to their colleagues.

It’s always encouraging to see that the 1-1 sessions were found to be very useful, having a positive impact on confidence levels with 100% of employees likely to recommend it to their colleagues.

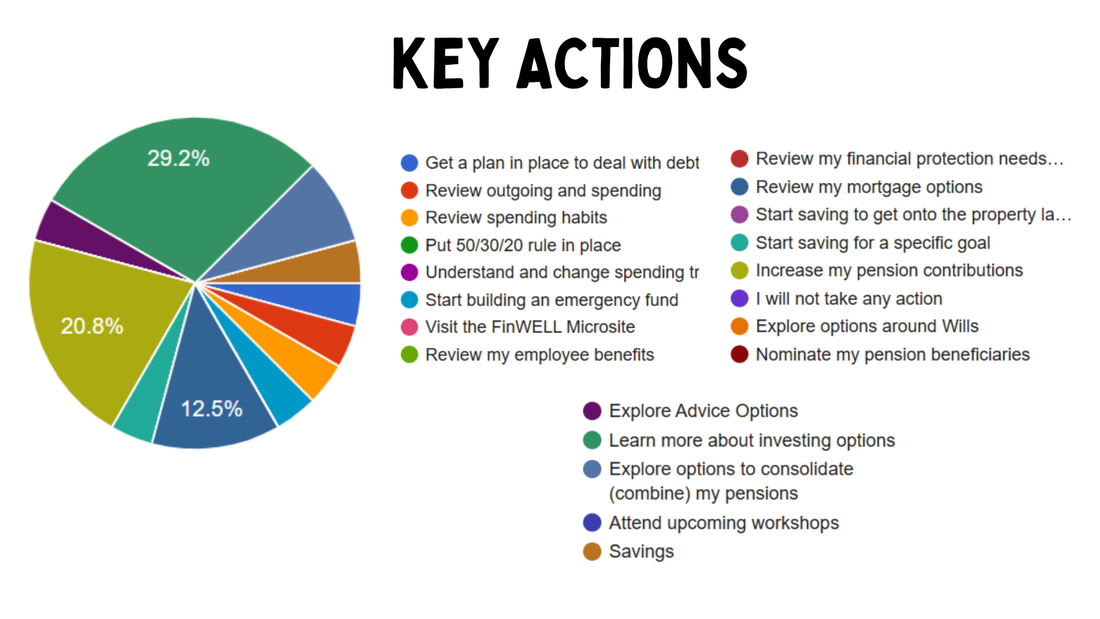

Analysis

We've recently introduced tracking of key outcomes and actions employees have committed to themselves in an effort to maximise impact and positive change.

You can see from this data that the three most common outcomes were to learn more about investing options, start building an emergency fund or to increase their pension contributions.

We've recently introduced tracking of key outcomes and actions employees have committed to themselves in an effort to maximise impact and positive change.

You can see from this data that the three most common outcomes were to learn more about investing options, start building an emergency fund or to increase their pension contributions.