FINANCIAL WELLBEING FOR EMPLOYERS & EMPLOYEES...

To celebrate #FinancialWellbeingMonth we're delighted to share even more free resources to help improve financial wellbeing, mental health and suicide prevention.

Book a discovery call to get free personal access to FinWELL Lite and also a downloadable versions of these infographics to email and print off for your teams.

Book a discovery call to get free personal access to FinWELL Lite and also a downloadable versions of these infographics to email and print off for your teams.

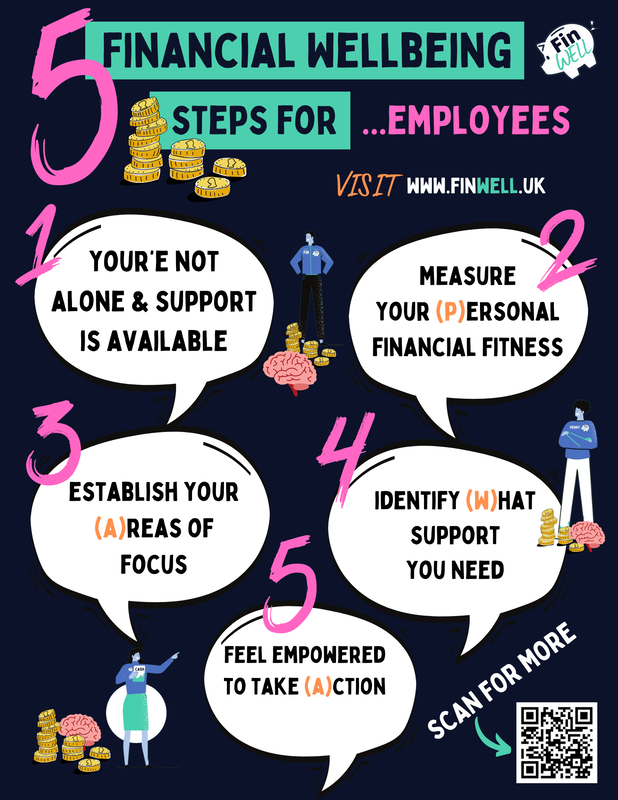

5 FINWELL STEPS FOR EMPLOYERS & EMPLOYEES...

5 TIPS FOR EMPLOYERS & EMPLOYEES

Top tips for employers

1. Ask your people what they want

Please don’t assume you know what your teams need, ask them, and then ensure you take action.

2. Create psychologically safe spaces

Like mental health, the first step is to be confident and comfortable to #TalkAboutMoney. Consider bringing your employee and leadership teams together to share stories and collate resources, hints, and tips.

3. Utilise existing benefits and suppliers

You probably have some great benefits and providers. Look at ways to build on these to improve the communication, understanding, and engagement to connect the dots to real life challenges.

4. Maximise your wellbeing ambassadors, champions, and first aiders

Create champions within your business and offer them ongoing training and support so they can put their own oxygen mask on before helping others around all aspects of wellbeing, including mental, financial, physical, and social.

5. Act now; start small but think inclusive, personalised, and long-term

Don’t wait for the perfect time to start. Start now and build your offering over time to ensure it can be inclusive to everyone but also personalised. Anything worth doing is worth doing right and will take time.

Top tips for employees

1. Understand that you’re not alone, support is available, and progress is possible.

Most of us didn’t learn the basics around money matters at school so give yourself a break. Now is a great chance to take back control.

2. Complete FinWELL’s P.A.W.A Plan to understand, measure, and improve your own financial fitness:

Personal money score - Give yourself a score out of 20 for each of these and add them up to form your total out of 100:

Areas of focus - Establish what stage of life you’re at and what needs your attention right now. Is it:

What area of support - Identify your next steps and the difference between:

Action taking - Feel empowered to take action by:

And lastly…an extra tip for anyone dealing with debt.

Getting your finances back on track

Debt is something that most of us have but none of us want to talk about.

If you feel that your debt is becoming unmanageable then it is time to act. Financial charity StepChange provides free, anonymous, and comprehensive financial advice to get your finances back on track. Whether it's to pay back what you owe with payments you can afford, write off your debts, or some time and space to sort out your finances, they have the solution to give you back your Financial PAWA!

Take a look at the real-life stories and case studies by visiting stepchange.org.

1. Ask your people what they want

Please don’t assume you know what your teams need, ask them, and then ensure you take action.

2. Create psychologically safe spaces

Like mental health, the first step is to be confident and comfortable to #TalkAboutMoney. Consider bringing your employee and leadership teams together to share stories and collate resources, hints, and tips.

3. Utilise existing benefits and suppliers

You probably have some great benefits and providers. Look at ways to build on these to improve the communication, understanding, and engagement to connect the dots to real life challenges.

4. Maximise your wellbeing ambassadors, champions, and first aiders

Create champions within your business and offer them ongoing training and support so they can put their own oxygen mask on before helping others around all aspects of wellbeing, including mental, financial, physical, and social.

5. Act now; start small but think inclusive, personalised, and long-term

Don’t wait for the perfect time to start. Start now and build your offering over time to ensure it can be inclusive to everyone but also personalised. Anything worth doing is worth doing right and will take time.

Top tips for employees

1. Understand that you’re not alone, support is available, and progress is possible.

Most of us didn’t learn the basics around money matters at school so give yourself a break. Now is a great chance to take back control.

2. Complete FinWELL’s P.A.W.A Plan to understand, measure, and improve your own financial fitness:

Personal money score - Give yourself a score out of 20 for each of these and add them up to form your total out of 100:

- General confidence

- Relationship with money

- Ability to pay bills

- Financial resilience

- Future plans

Areas of focus - Establish what stage of life you’re at and what needs your attention right now. Is it:

- Money management?

- The property ladder?

- Protecting what’s important?

- Investing for the future?

- Modern retirement planning?

What area of support - Identify your next steps and the difference between:

- Educational content (find credible articles, videos, podcasts, and infographics)

- Financial guidance (group workshops or one-to-one support)

- Financial advice (regulated products based on your needs, seek professional advice and understand costs)

Action taking - Feel empowered to take action by:

- Allocating time in your busy diary

- Buddying up with a friend, partner, family member, or colleague who has the same area of focus to continue the conversation and keep each other accountable

And lastly…an extra tip for anyone dealing with debt.

Getting your finances back on track

Debt is something that most of us have but none of us want to talk about.

If you feel that your debt is becoming unmanageable then it is time to act. Financial charity StepChange provides free, anonymous, and comprehensive financial advice to get your finances back on track. Whether it's to pay back what you owe with payments you can afford, write off your debts, or some time and space to sort out your finances, they have the solution to give you back your Financial PAWA!

Take a look at the real-life stories and case studies by visiting stepchange.org.

UNDERSTAND, MEASURE & IMPROVE FINANCIAL WELLBEING IN FOUR SIMPLE STEPS WITH FINWELL PAWA PLANS...

|

Watch this video first!

|

Then watch this video...

|

|

You've got it, this one next!

|

You're doing great, now this one!

|

|

Keep going, now this one...

|

Then onto this one...

|

|

You'll feel even better after this one!

|

Not far to go now...

|

|

One final effort!

|

You've done it! Now watch this for your company!

|