Hays - FinWELL Data Analysis

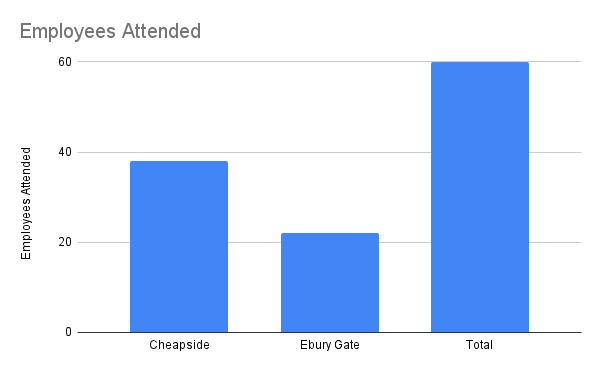

Employees Attended

We delivered sessions to a total of 60 employees with 38 at Cheapside and 22 at Ebury Gate.

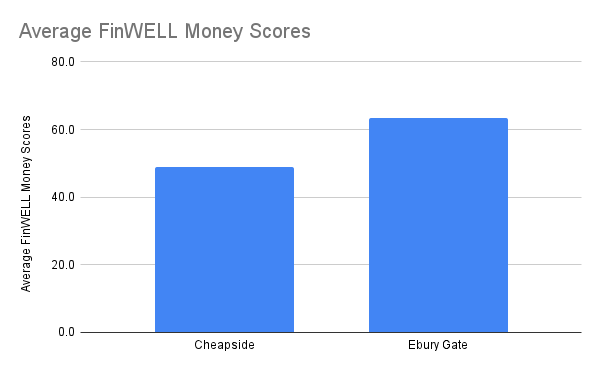

Total Average FinWELL Scores

It's interesting to see that the Average FinWELL Money Score was 48.9/100 for employees at Cheapside and 63.5/100 for Ebury Gate.

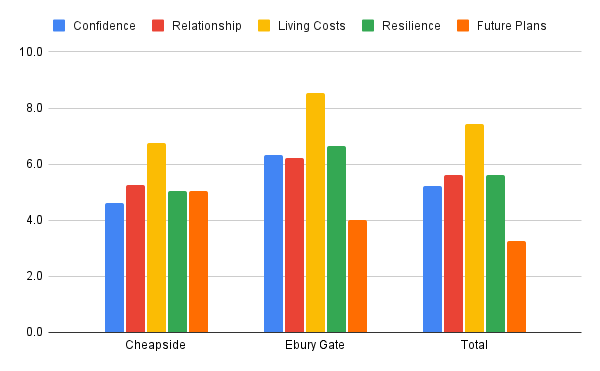

Detailed Average FinWELL Scores

Our findings show the average FinWELL Money Scores for each of the key elements of financial wellbeing. The highest score (6.8/10 for Cheapside, 8.5/10 for Ebury Gate and 7.4/10 in total) was for the ability to pay bills and cover living costs (although there was much concern about the rising cost of living).

The lowest (5/10 for Cheapside, 4/10 for Ebury Gate and 3.3/10 in total) was for having Future Plans (understanding how pensions work and basic investment options to make money work harder).

The lowest (5/10 for Cheapside, 4/10 for Ebury Gate and 3.3/10 in total) was for having Future Plans (understanding how pensions work and basic investment options to make money work harder).

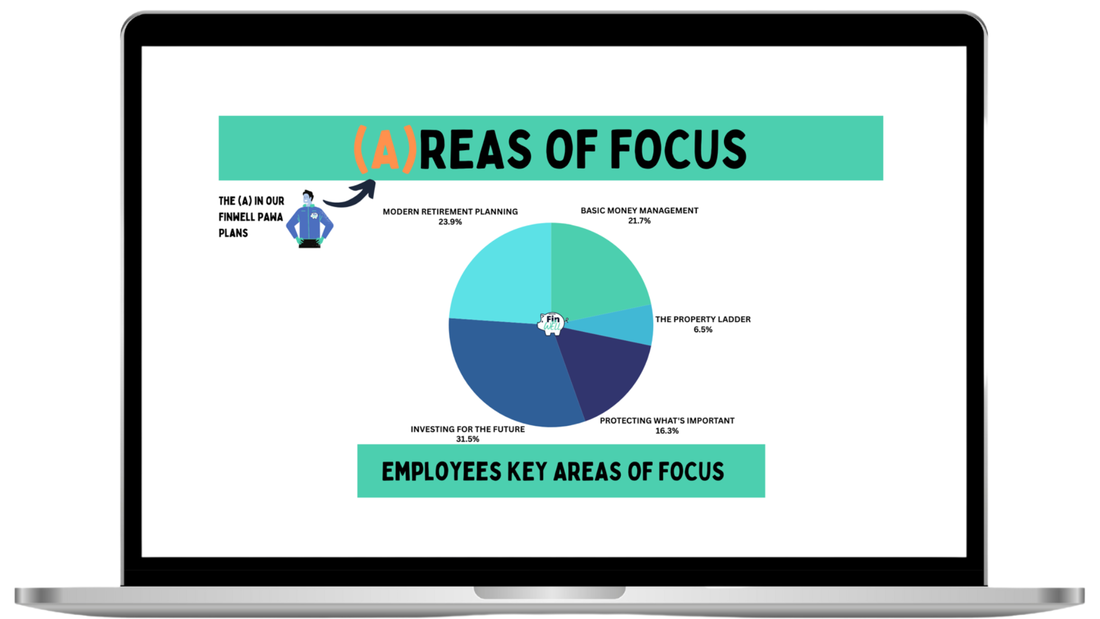

Key Areas of Focus

This data shows that the most popular Area of Focus for employees at both offices is Investing For Future and Money Management with the least popular, although still important, being Protection.

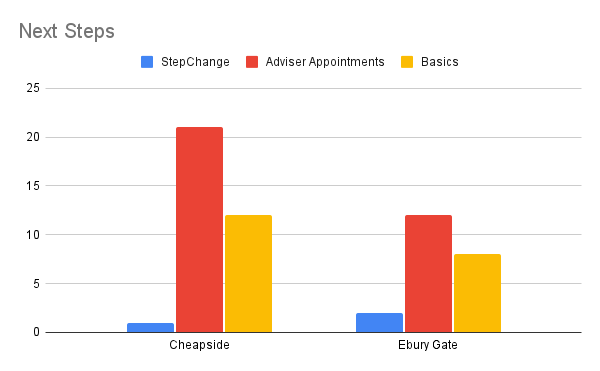

Next Steps for Employees

We had three cases that required signposting to StepChange Debt Charity due to increasing levels of debt. This is not a particularly high ratio but does confirm the need to raise awareness of services available by the likes of StepChange for employees.

There were a total of 33 enquiries for professional advice (21 at Cheapside and 12 at Ebury Gate) including Mortgages, Investments, Pension Reviews, Wills and Estate Planning.

The next steps for the rest was further education around Basic Money Management including Budgeting, The 50/30/20 Rule and Building Emergency Funds.

All attendees received a follow up email setting out their FinWELL PAWA Plan. This confirmed their (P)ersonal FinWELL Money Scores, their (A)reas of Focus, (W)hat their Next Steps are and how to take (A)ction.

They were also sent links to specific content on the FinWELL Microsite created specifically for Hays giving them personalised and relevant resources including videos, articles and infographics.

Those who enquired about a need for professional advice we’re introduced via a seperate email to one of our approved providers.

All attendees were also invited to connect on LinkedIn giving them access to ongoing support and ask further questions as-well as keeping updated with educational posts from our FinWELL LinkedIn page.

There were a total of 33 enquiries for professional advice (21 at Cheapside and 12 at Ebury Gate) including Mortgages, Investments, Pension Reviews, Wills and Estate Planning.

The next steps for the rest was further education around Basic Money Management including Budgeting, The 50/30/20 Rule and Building Emergency Funds.

All attendees received a follow up email setting out their FinWELL PAWA Plan. This confirmed their (P)ersonal FinWELL Money Scores, their (A)reas of Focus, (W)hat their Next Steps are and how to take (A)ction.

They were also sent links to specific content on the FinWELL Microsite created specifically for Hays giving them personalised and relevant resources including videos, articles and infographics.

Those who enquired about a need for professional advice we’re introduced via a seperate email to one of our approved providers.

All attendees were also invited to connect on LinkedIn giving them access to ongoing support and ask further questions as-well as keeping updated with educational posts from our FinWELL LinkedIn page.

General Findings & Specific Case Studies

The feedback from 1-1 sessions was exceptionally positive with common trends around them being informal yet informative and an appreciation for an opportunity to discuss personal finances in a safe environment while at work.

Many commented on the sessions being insightful, learning about the various elements of financial wellbeing including general knowledge, understanding and confidence, relationships with money going back to childhood, ability to pay bills and cost of living, financial resilience (emergency funds) and future plans.

Another common theme was that the sessions were seen to be non-judgmental with a personable and friendly approach but with structure and clear outcomes.

It's interesting to see these results and also the comparisons between the two offices although there were more attendees at Cheapside.

Neuro-diversity

A number of sessions identified the additional challenges faced by neuro-diverse individuals.

This is something we are passionate about improving and have a specific focus on so welcome Hays to work with us on this moving forward.

Specific Case Studies

I was particularly encouraged by a particular session we had with an individual who's parents were unfortunately suffering with terminal ill-health. This was an emotional session for the individual as they were understandably struggling to deal with the situation itself as-well as the legal and financial implications.

This resulted in an introduction to one our trusted partner on the Financial Advice side and then another subsequent emotional appointment.

This then led to suitable legal and financial advice being made available to the individual that simply would not have happened if Hays had not implemented this financial wellbeing initiative.

Other cases (although only a few) highlighted the importance of effective signposting to StepChange Debt Charity where there was a need to tackle growing challenges around debt.

Finally, it was encouraging to get positive feedback from a range employees at junior, middle and senior management confirming that financial wellbeing is something that applies to everyone.

Many commented on the sessions being insightful, learning about the various elements of financial wellbeing including general knowledge, understanding and confidence, relationships with money going back to childhood, ability to pay bills and cost of living, financial resilience (emergency funds) and future plans.

Another common theme was that the sessions were seen to be non-judgmental with a personable and friendly approach but with structure and clear outcomes.

It's interesting to see these results and also the comparisons between the two offices although there were more attendees at Cheapside.

Neuro-diversity

A number of sessions identified the additional challenges faced by neuro-diverse individuals.

This is something we are passionate about improving and have a specific focus on so welcome Hays to work with us on this moving forward.

Specific Case Studies

I was particularly encouraged by a particular session we had with an individual who's parents were unfortunately suffering with terminal ill-health. This was an emotional session for the individual as they were understandably struggling to deal with the situation itself as-well as the legal and financial implications.

This resulted in an introduction to one our trusted partner on the Financial Advice side and then another subsequent emotional appointment.

This then led to suitable legal and financial advice being made available to the individual that simply would not have happened if Hays had not implemented this financial wellbeing initiative.

Other cases (although only a few) highlighted the importance of effective signposting to StepChange Debt Charity where there was a need to tackle growing challenges around debt.

Finally, it was encouraging to get positive feedback from a range employees at junior, middle and senior management confirming that financial wellbeing is something that applies to everyone.

Feedback

“Everyone should have access to this especially in recruitment. I really liked that it was non-judgmental and access to ongoing support. I also liked the 50/30/20 rule and tips about emergency funds.”

"I really liked the layman's approach that was non-judgmental and knowledge of the speaker."

"I liked the key areas of focus especially the 50/30/20 rule which is so useful for people in recruitment."

"I really liked the opportunity to discuss things that we don't normally get to address at work. I really appreciated this."

"I really enjoyed my time with Ryan and felt good to be able to explain what was worrying me in a totally non-judgmental way. Its great to feel that there is help and support to make the most out of my situation."

"This was really informative exploring new ideas such as the 50/30/20 Rule and other help with savings. It was personable, easy and non-judgmental."

"It was really good and like that there is a summary email that will outline next steps. I feel empowered to get my finances in order."

"This is so important as your finances can really affect your wellbeing and really appreciate Hays offering this. I took away some useful information and a clear plan. Ryan was very understanding and non-judgmental."

"I really liked reflecting on the key elements of financial planning."

"This can really help you understand your goals and set some actions. I liked the clear structure and different elements around financial wellbeing. It helped me understand my weaknesses and strengths and where I might value most support."

"It was a really useful session, informative but informal allowed me to reflect on my current financial situation and what areas I should focus on at this point in my life and also the future."

"Regardless of the amount I have earnt in recruitment I am still on edge about my future in a commission job and this has really taken the anxiety away. He was really informative and clearly passionate so I felt it was trusted and impartial. It was great that he had experience of recruitment too."

"The chat was very easy going with no pressure to say anything you didn't want to. The conversation was very real and genuine."

"This is great to help us manage our money better and think about the future. The session was non judgmental and took on board my comments offering further support that is suitable for me personally."

"I liked how comfortable I felt during the session was able to share where I am at financially and what I need to consider to get where I want to be. I really liked the budgeting basics and info about the 50/30/20 rule and emergency funds."

"This was a great session and handy for anyone who is new to financial wellbeing. Very informal and great approach. It was relaxed but informative with many take-aways from the session explaining step by step with a personalised action plan."

"This is the key to understanding money management and whats important for the future. Money is a taboo subject so its good to get confidence from speaking to someone. Ryan was friendly and approachable."

"This is a good opportunity to discuss my situation with somebody outside my normal circle that can provide help and support around financial wellbeing. It was really insightful and would be good as an employee benefit. Particularly liked the info around money management."

"This is so important as our finances play a huge part in our lives and affects all other areas. I liked the reflection on PAWA and gave me a good idea of my next steps."

"Knowing how to manage your money is extremely important. Ryan was able to provide guidance on all areas now and for the future so its great for employees to have access to this. Ryan is very personable and putting me in touch with trusted specialists for professional advice. Its great to know we have ongoing support."

"You need to plan for the future and it was very helpful to get guidance and referred to trusted people. Need to start considering financial wellbeing early. This is something that is important for middle and senior managers just as much as recruiters and other staff."

"This can really help your financial wellbeing and make you aware of your situation. I really liked the 50/30/20 rule and is a good starting point."

"It was so good to be able to talk to someone in private about my financial situation without judgement. I was completely unaware of StepChange and it's a relief to know that help is available to get back on track. Very friendly and understanding."

"Financial Wellbeing is very important and anyone should consider a guidance session as financial health can impact physical and mental health. The thing I liked most was the simple layout of the session and that there is ongoing support. It's good that Hays offer this service and in work time."

"Understanding money management can help reduce stress and allows energy to be put towards the important things. I liked that the trainer was very articulate and can introduce me to people who will help me achieve my goals."

"This is such important guidance to prepare for the future. Some really good guidance and how to take action. I feel better about my financial situation having been able to discuss it."

"It's really useful to identify where I need to improve when it comes to money. I was unaware of StepChange and will be making contact to see what help they can offer."

"I really liked the layman's approach that was non-judgmental and knowledge of the speaker."

"I liked the key areas of focus especially the 50/30/20 rule which is so useful for people in recruitment."

"I really liked the opportunity to discuss things that we don't normally get to address at work. I really appreciated this."

"I really enjoyed my time with Ryan and felt good to be able to explain what was worrying me in a totally non-judgmental way. Its great to feel that there is help and support to make the most out of my situation."

"This was really informative exploring new ideas such as the 50/30/20 Rule and other help with savings. It was personable, easy and non-judgmental."

"It was really good and like that there is a summary email that will outline next steps. I feel empowered to get my finances in order."

"This is so important as your finances can really affect your wellbeing and really appreciate Hays offering this. I took away some useful information and a clear plan. Ryan was very understanding and non-judgmental."

"I really liked reflecting on the key elements of financial planning."

"This can really help you understand your goals and set some actions. I liked the clear structure and different elements around financial wellbeing. It helped me understand my weaknesses and strengths and where I might value most support."

"It was a really useful session, informative but informal allowed me to reflect on my current financial situation and what areas I should focus on at this point in my life and also the future."

"Regardless of the amount I have earnt in recruitment I am still on edge about my future in a commission job and this has really taken the anxiety away. He was really informative and clearly passionate so I felt it was trusted and impartial. It was great that he had experience of recruitment too."

"The chat was very easy going with no pressure to say anything you didn't want to. The conversation was very real and genuine."

"This is great to help us manage our money better and think about the future. The session was non judgmental and took on board my comments offering further support that is suitable for me personally."

"I liked how comfortable I felt during the session was able to share where I am at financially and what I need to consider to get where I want to be. I really liked the budgeting basics and info about the 50/30/20 rule and emergency funds."

"This was a great session and handy for anyone who is new to financial wellbeing. Very informal and great approach. It was relaxed but informative with many take-aways from the session explaining step by step with a personalised action plan."

"This is the key to understanding money management and whats important for the future. Money is a taboo subject so its good to get confidence from speaking to someone. Ryan was friendly and approachable."

"This is a good opportunity to discuss my situation with somebody outside my normal circle that can provide help and support around financial wellbeing. It was really insightful and would be good as an employee benefit. Particularly liked the info around money management."

"This is so important as our finances play a huge part in our lives and affects all other areas. I liked the reflection on PAWA and gave me a good idea of my next steps."

"Knowing how to manage your money is extremely important. Ryan was able to provide guidance on all areas now and for the future so its great for employees to have access to this. Ryan is very personable and putting me in touch with trusted specialists for professional advice. Its great to know we have ongoing support."

"You need to plan for the future and it was very helpful to get guidance and referred to trusted people. Need to start considering financial wellbeing early. This is something that is important for middle and senior managers just as much as recruiters and other staff."

"This can really help your financial wellbeing and make you aware of your situation. I really liked the 50/30/20 rule and is a good starting point."

"It was so good to be able to talk to someone in private about my financial situation without judgement. I was completely unaware of StepChange and it's a relief to know that help is available to get back on track. Very friendly and understanding."

"Financial Wellbeing is very important and anyone should consider a guidance session as financial health can impact physical and mental health. The thing I liked most was the simple layout of the session and that there is ongoing support. It's good that Hays offer this service and in work time."

"Understanding money management can help reduce stress and allows energy to be put towards the important things. I liked that the trainer was very articulate and can introduce me to people who will help me achieve my goals."

"This is such important guidance to prepare for the future. Some really good guidance and how to take action. I feel better about my financial situation having been able to discuss it."

"It's really useful to identify where I need to improve when it comes to money. I was unaware of StepChange and will be making contact to see what help they can offer."

Recommendation

We would be delighted to continue our progress and collaborative partnership with Hays exploring opportunities to expand this offering to other offices in the UK and even globally.

We have discussed the potential to implement our digital solution when the time is right and for now would welcome visiting other offices while continuing our work with Cheapside and Ebury Gate.

I believe that we can now reduce the London office visits to a monthly basis (two per month in total) leaving capacity to allocate an additional four afternoons per month (8 x 1-1 sessions per afternoon) at other locations meaning a total of 48 employees having 1-1 sessions at various locations per month on a face to face or online basis.

Costs

Six block bookings (48 sessions) would normally cost £3,600 per month.

Due to our growing relationship, we propose that we continue this work at selected Hays offices for a much reduced fee of £1,200 per month (80% discount) for a six month period before reviewing again.

We will also include 2 interactive group workshops at half price that can be utilised in quarter one and quarter two of 2023 (saving an further £400).

FinWELL Training for Leadership & Wellbeing Champions

We have discussed our development of FinWELL Training to upskill Leadership and Wellbeing Champions complimenting their knowledge and experience around mental health and wellbeing.

We would be delighted to get feedback and insight from the team at Hays and offer this training at preferential rates when it is ready and should it be of interest.

Digital Dashboard - Pilot Trial Accounts

We can also give you access to a limited number of free accounts to our new digital dashboard for key individuals at Hays to trial it for themselves before potentially rolling out with various offices.

Feel free to discuss and I welcome any questions you may have.

We have discussed the potential to implement our digital solution when the time is right and for now would welcome visiting other offices while continuing our work with Cheapside and Ebury Gate.

I believe that we can now reduce the London office visits to a monthly basis (two per month in total) leaving capacity to allocate an additional four afternoons per month (8 x 1-1 sessions per afternoon) at other locations meaning a total of 48 employees having 1-1 sessions at various locations per month on a face to face or online basis.

Costs

Six block bookings (48 sessions) would normally cost £3,600 per month.

Due to our growing relationship, we propose that we continue this work at selected Hays offices for a much reduced fee of £1,200 per month (80% discount) for a six month period before reviewing again.

We will also include 2 interactive group workshops at half price that can be utilised in quarter one and quarter two of 2023 (saving an further £400).

FinWELL Training for Leadership & Wellbeing Champions

We have discussed our development of FinWELL Training to upskill Leadership and Wellbeing Champions complimenting their knowledge and experience around mental health and wellbeing.

We would be delighted to get feedback and insight from the team at Hays and offer this training at preferential rates when it is ready and should it be of interest.

Digital Dashboard - Pilot Trial Accounts

We can also give you access to a limited number of free accounts to our new digital dashboard for key individuals at Hays to trial it for themselves before potentially rolling out with various offices.

Feel free to discuss and I welcome any questions you may have.

FinWell offers financial wellbeing services through education, guidance, training and support.

No information or content shared on our website, workshop or 1-1 session should be taken as advice.

We can signpost to further resources and partnering organisations who offer professional advice or you can seek advice through other authorised and regulated companies and individuals.

FinWELL may receive a fee for services provided by our collaborative partner providers.

FINWELL TRAINING LTD

COMPANY NUMBER: 14126502

PRIVACY NOTICE

No information or content shared on our website, workshop or 1-1 session should be taken as advice.

We can signpost to further resources and partnering organisations who offer professional advice or you can seek advice through other authorised and regulated companies and individuals.

FinWELL may receive a fee for services provided by our collaborative partner providers.

FINWELL TRAINING LTD

COMPANY NUMBER: 14126502

PRIVACY NOTICE